San Diego Home Insurance Fundamentals Explained

San Diego Home Insurance Fundamentals Explained

Blog Article

Safeguard Your Home and Loved Ones With Affordable Home Insurance Coverage Plans

Significance of Affordable Home Insurance

Securing inexpensive home insurance is essential for protecting one's home and monetary well-being. Home insurance provides defense versus numerous threats such as fire, theft, all-natural catastrophes, and personal liability. By having a thorough insurance strategy in area, house owners can relax guaranteed that their most substantial financial investment is shielded in the event of unexpected circumstances.

Economical home insurance not just provides economic safety and security yet additionally supplies satisfaction (San Diego Home Insurance). In the face of increasing home worths and building and construction costs, having an affordable insurance plan ensures that house owners can quickly restore or repair their homes without dealing with considerable economic concerns

In addition, economical home insurance coverage can additionally cover personal possessions within the home, supplying repayment for items harmed or stolen. This protection expands past the physical structure of your home, shielding the contents that make a home a home.

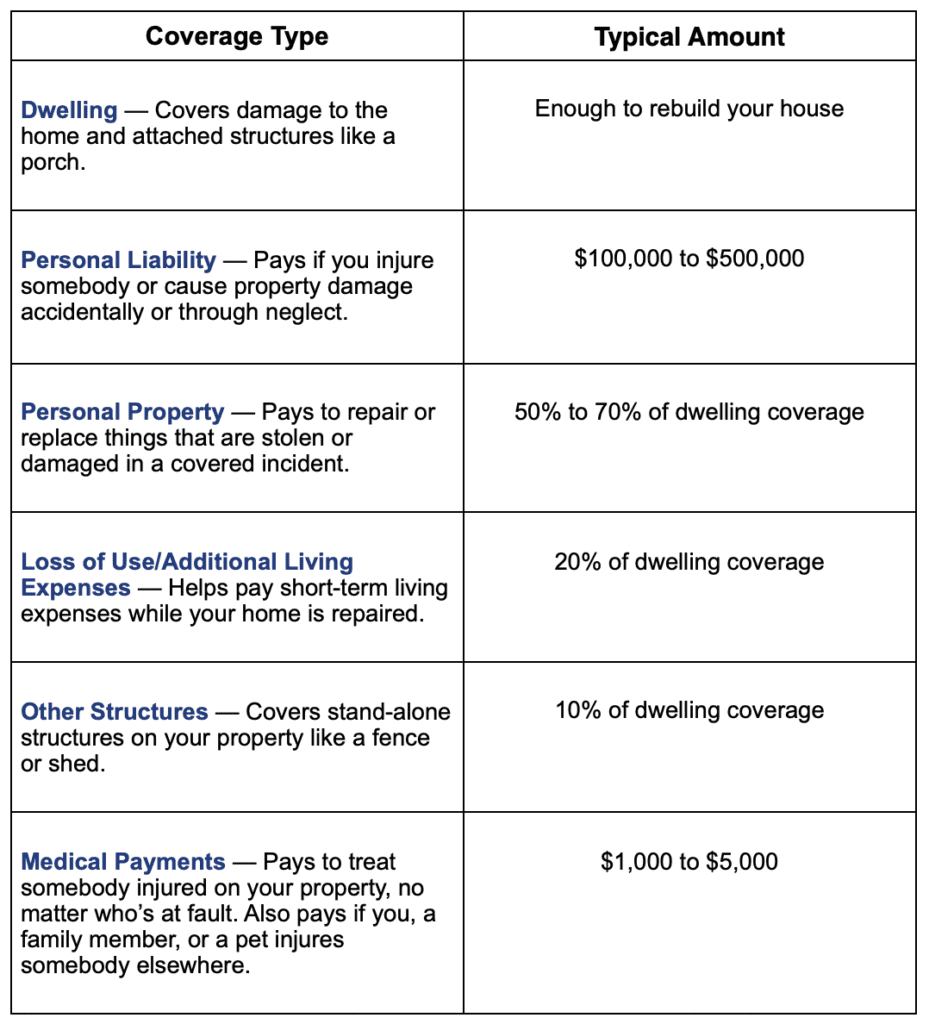

Protection Options and Limits

When it concerns protection limitations, it's essential to understand the optimum amount your plan will certainly pay for each kind of protection. These restrictions can differ depending on the policy and insurance firm, so it's necessary to review them carefully to guarantee you have ample defense for your home and properties. By comprehending the protection alternatives and limits of your home insurance coverage, you can make enlightened decisions to secure your home and liked ones successfully.

Aspects Impacting Insurance Coverage Prices

Numerous variables significantly affect the costs of home insurance coverage policies. The area of your home plays an important duty in determining the insurance policy premium.

Additionally, the type of coverage you pick straight affects the expense of your insurance coverage plan. Selecting extra protection choices such as flooding insurance policy or quake protection will certainly increase your premium. Selecting higher insurance coverage restrictions will result in higher expenses. Your insurance deductible quantity can also impact your insurance costs. A greater insurance deductible usually implies reduced costs, yet you will have to pay even more expense in case of an insurance claim.

In addition, your credit report, declares history, and the insurer you select can all affect the cost of your home insurance coverage. By thinking about these variables, you can make enlightened choices to aid handle your insurance policy costs effectively.

Comparing Quotes and Suppliers

In addition to contrasting quotes, it is crucial to assess the credibility and monetary security of the insurance service providers. Try to find client evaluations, scores from independent companies, and any background of complaints or regulatory actions. A reliable insurance service provider ought to have an excellent track record of promptly refining cases and giving superb client service.

Additionally, consider the details insurance coverage attributes supplied by each provider. Some insurers might provide fringe benefits such as identity burglary security, equipment breakdown protection, or coverage for high-value things. By thoroughly contrasting quotes and suppliers, you can make a notified decision and select the home insurance policy strategy that best satisfies your needs.

Tips for Reducing Home Insurance Policy

After completely contrasting service providers and quotes to locate the most appropriate insurance coverage for your requirements and spending plan, it is prudent to check out reliable techniques for reducing home insurance. Among the most considerable means to save money on home insurance coverage is by packing your policies. Lots of insurance coverage business supply discounts if you buy numerous plans from them, such as combining your home and car insurance policy. Increasing your home's protection measures can also result in financial savings. Installing safety systems, smoke detectors, deadbolts, or a sprinkler system can minimize the threat of damages or burglary, possibly decreasing your insurance coverage costs. In addition, keeping an excellent credit report can positively impact your home insurance coverage prices. Insurers frequently consider credit score background when establishing costs, so paying next page costs promptly and handling your credit sensibly can cause reduced insurance coverage expenses. Lastly, consistently useful reference examining and updating your policy to reflect any kind of adjustments in your house or circumstances can ensure you are not spending for insurance coverage you no longer need, aiding you conserve money on your home insurance policy premiums.

Conclusion

In conclusion, protecting your home and liked ones with affordable home insurance policy is important. Carrying out ideas for saving on home insurance coverage can also aid you safeguard the needed security for your home without breaking the financial institution.

By unraveling the details of home insurance plans and discovering sensible methods for safeguarding inexpensive coverage, you can make certain that your home and liked ones are well-protected.

Home insurance coverage policies generally offer numerous protection options to protect your home and belongings - San Diego Home Insurance. By understanding the protection alternatives and restrictions of your home insurance coverage plan, you can make enlightened choices to protect your home and loved ones successfully

Frequently evaluating and upgrading your policy to mirror any type Visit Your URL of adjustments in your home or conditions can guarantee you are not paying for insurance coverage you no longer requirement, assisting you conserve money on your home insurance coverage costs.

In final thought, securing your home and enjoyed ones with affordable home insurance policy is important.

Report this page